Like most brokerage house reports, JLL’s “Office Outlook, 2Q 2013” has a lot of optimism based on quarter-to-quarter market chatter. The report also has some good longer-term stats, though, and when I look at the key indicators among those, I come to some different conclusions about how soon the market may turn around. My conclusion: a new “normal” sometime after 2027.

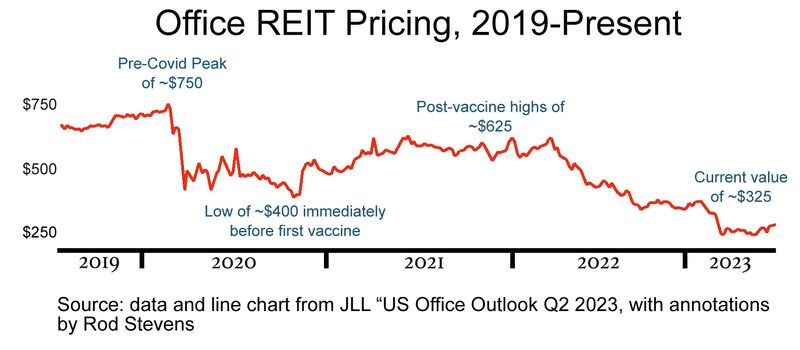

Let’s start with the JLL chart of REIT values shown below, which is a good proxy for office values overall. Current values are less than half pre-Covid and are below even the Covid trough. Sometime about a year ago, investors realized telecommuting would permanently reduce space needs per worker. Low equity expectations will also affect the availability of turnaround financing.

JLL thinks there will be a “cascading recovery” because buildings built since 2015 have leased well, but look further and see that for every square foot of newer space leased since the pandemic, two square feet of older space have gone dark. Tenants are simply trading up. Net absorption is still negative, pushing the most recent vacancy rate to 20.3%. With 1/3 of the leased space coming due in the next three years, it’s likely the vacancy rate will go higher.

With vacancies this high, some owners are simply taking their buildings off the market, perhaps because they don’t have the cash flow for tenant improvement, better air circulation, shared amenities, or other updates. JLL’s stats show that perhaps for the first time ever, almost twice as much space is now being removed from the market as built. That removal rate is four times the annual average of the previous 20 years and will increase with the number of loan defaults.

The real unknown is how quickly empty property can find new owners, uses, and financing. That took about seven years after the S&L crisis, Positively, for the office market, the restructuring industry is more sophisticated now. Negatively, workers now come in less frequently. My best guess for a new “normal” of value, ownership, and use is sometime after 2027.